October Fund Performance

Cracks.

Hi Everyone,

See below month end fund performance data ranked by monthly performance.

HOUSEKEEPING

If you want to read this on another site with interactive tables that you can click through on, click below:

Seriously, the tables are much nicer on this link - CLICK HERE

If you are receiving this via email, I suggest clicking the link and reading directly on Substack. The email formatting does not translate well and the information may appear as clipped or truncated in your inbox due to the size and length of the Substack post.

If this forwarded to you, feel free to respond to the Substack email or just send a sign up request on mrquick@substack.com or contact@ausyield.com.au

All tables are sorted by 1-month performance, with benchmark rows highlighted where relevant.

Fixed Income

Last month I questioned the idea of peak rates? So wrong.

Aus rate cut priced in as practically zero chance. And with the RBA forecasting inflation to be over 3% for a little bit of time, the chance of a rate rise is non-zero.

Zero chance of rate cut + non-zero chance of inflation above 3% = worries

Very plainly Aus inflation was +3.2% last year and I wonder how real returns fare with base rates around inflation levels while spreads are super duper narrow

Not surprising to see the most equity like fund (Capital Securities) top the 1yr table.

And also, not surprising to see EM debt fund which had a 20%+ YTM 3 years ago deliver the best returns over that period.

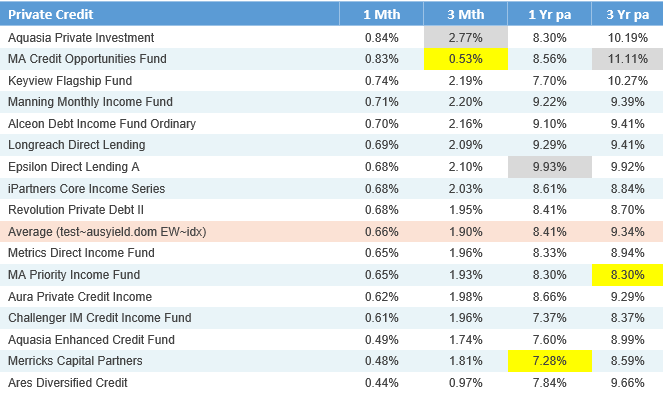

Private Credit - Domestic Vehicles

I was surprised the ASIC paper didn’t go harder.

Only select domestic managers with 3yr track record shown below

I’m not covering the global managers coming into our market (yet), but a lot of those are reflective of BDCs in the US, interesting (volatile!) times for many of these funds.

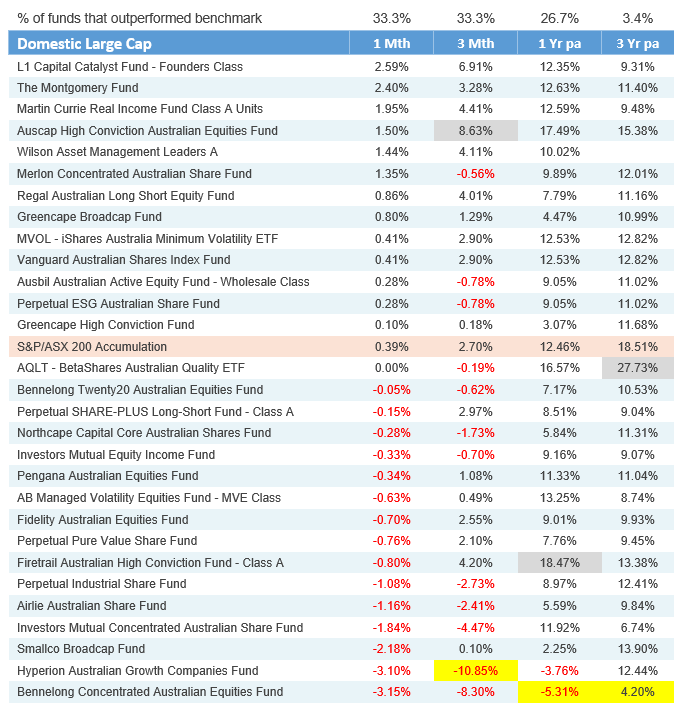

Domestic Large Cap

Such a small number of funds actually outperforming the ASX200 over 3 years

CSL representing the largest detractor for funds across the board in terms of LT alpha - it represented the largest overweight across most funds when they allocated away from CBA

MIN carrying a fair few funds this month too

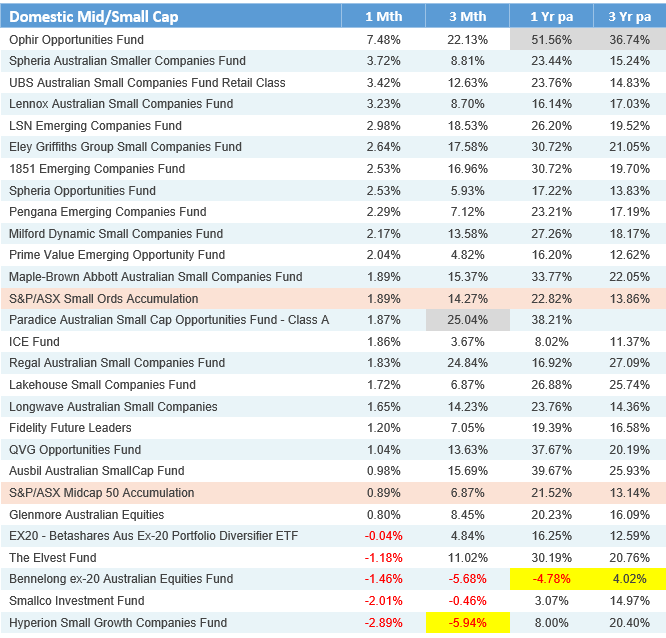

Domestic Mid/Small Cap

Lots of absurd returns in the last 3 months, some getting caught up in Nov now

Bennelong capital destruction is just something else

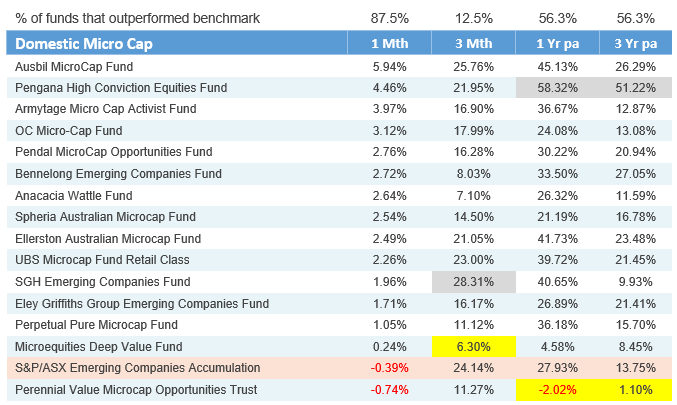

Domestic Micro-Cap

Gold helping the index along in a big way along with a fair bit more capital being allocated in this part of the market

High teen average returns over 3 years, but Perennial practically flat over the same period…

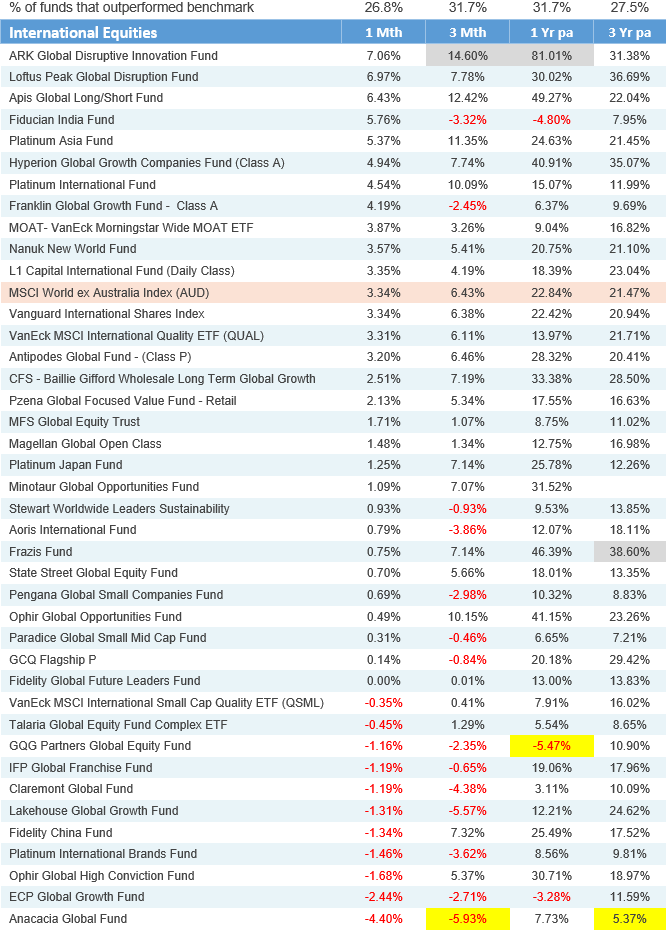

International Equities

When you see ARK topping 1 year numbers, you know markets have probably run a little bit too hard

Quality bubble deflating

GQG… mighty hard coming back from that. Missed the benchmark by 27% over the year and over 10%pa over 3 years. Huge catch up to get back to evens.

What about all the allocators holding this because it was “low cost” active management exposure?

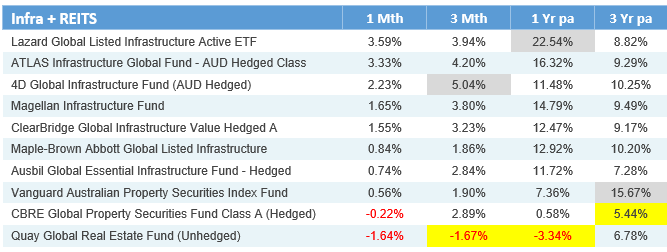

Infra + REITS

Global bonds generated circa 4%pa over 3 years, whereas holding long dated yielding infrastructure more than doubled that return

If we see inflation rise again, does this represent a good allocation? What about an inflation benign scenario?

Inflation protection on one hand and leverage to a falling 10yr on the other?

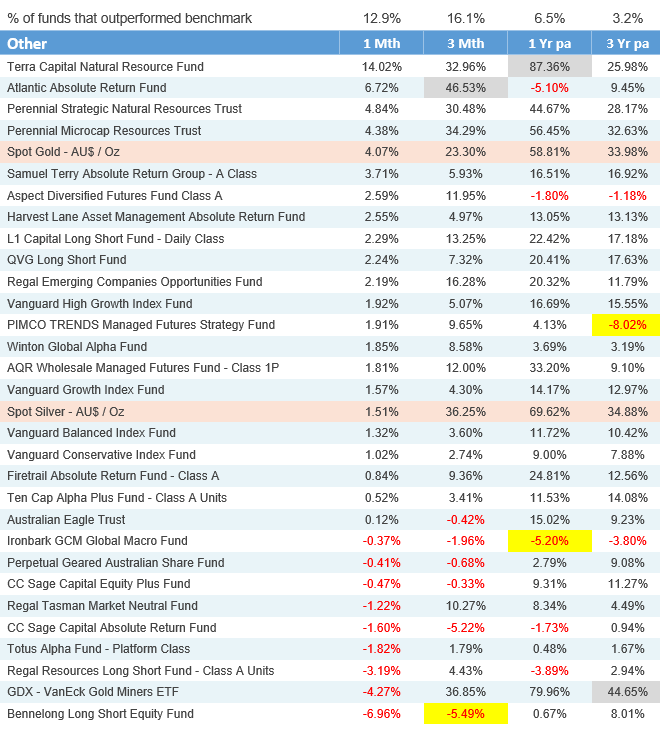

Other

Finally have our first fund (Terra) that beats the price of gold over the last 12 months. And another that’s hot on the tails of gold over 3 years.

Terra & Perennial generating absurd alpha.

The scarier part for me is that MSCI World has beaten everyone in this table other than those 2 managers over 3 years.

That is to say that most of the managers in this list are high cost, high alpha focused, yet global equity beta has stripped out those returns.

This is not a comment on active management or a reflection on any of these funds, but you can see why passive is getting bigger

So, what is more important, portfolio management or manager selection?

Aspect, Winton and PIMCO Trends all generating below inflation level returns over the last 3 years, yet AQR absolutely destroying all its competitors

If you’re looking at the managed futures space, the question is how much equity risk do you carry?

See Cliff’s latest interview and watch him try to explain near-term performance. I don’t like that explanation…

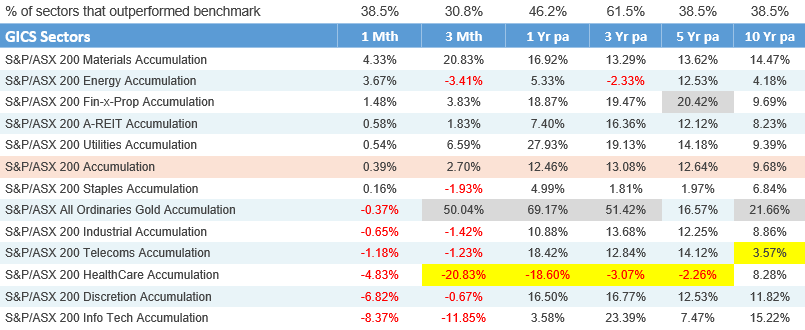

GICS Sectors

Only the banks beat gold over the last 5 years

CSL utterly crunching healthcare returns, might need an ex-CSL benchmark due to the overweight

Telstra both carrying telecoms returns over the last 5 and also destroying index returns over the last 10 years

Energy I find most fascinating, 5 year number not too bad because of a period of “super profits” but disgusting 10yr return

Its the sector that gets me the most excited, plenty of excess supply globally and names are beaten down. AI demand for energy has to go somewhere?

Utilities the energy linked dark horse however, pumping along nicely.

Bonus Round

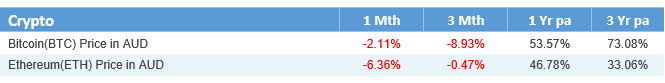

Crypto crunchtime, with the ultimate question being whether the ETFs provide market stability or not?

The ETFs will make this an interesting trade; I have a thesis around this:

The access for investors (retail & insto) has rapidly increased

Retail selling + insto having an easy mechnaism to short – reflexivity the other way

The ETF outflows will pick up to a significant pace and at some point a liqudiity crunch will mean price will utterly tank, worst dump ever

But I could also be totally wrong, the dip buying could happen much quicker here

More comments in “Thought of the month”

Thought of the month

The Comfort Trap

Finance has become more democratised apparently with the introduction of the vehicles only the big end of town could afford. Private markets, our lord and saviour!

One of the neater features of private markets is that they allow allocators to be lazy. Post-08, we obsessed over “behavioural finance”. But since being blessed by the great democratisation, we’ve stopped working on our counter-cyclical behaviours. Instead, we just allocate to assets that don’t mark-to-market during a drawdown.

A bit of vol laundering doesn’t go astray between friends aye?

We can argue about why this is right or wrong (Risk cannot be destroyed, only transformed!) but rather we can simply acknowledge that this is becoming more prevalent across all portfolios.

The Cost of Laziness

Why did I say lazy? Frankly, if you hold enough private assets, you can ignore major market moves (I’m looking at you, 2022) and be lazy from a rebalancing perspective.

Dear reader, I am absolutely going to accuse you right now that you’re allocating to private markets because it makes your life easier.

But when you hide in private markets to avoid volatility, you lose the ability to exploit volatility. Right now, we are watching a live-fire exercise in volatility. We are roughly 30% off the highs in the wildest asset class of them all.

Rather than sitting around being reactive, let’s build a framework that allows you to act.

A Live-Fire Exercise: Bitcoin

I’ve spent time on this because the ultimate limiting factor in investing is ALWAYS psychology. We react emotionally because we don’t have a plan, instead we just react to headlines, price action, and whatever your favourite bear is saying.

For this exercise, I’m going to use the wildest asset you can allocate to, Bitcoin!

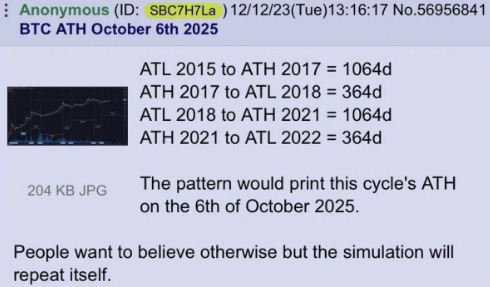

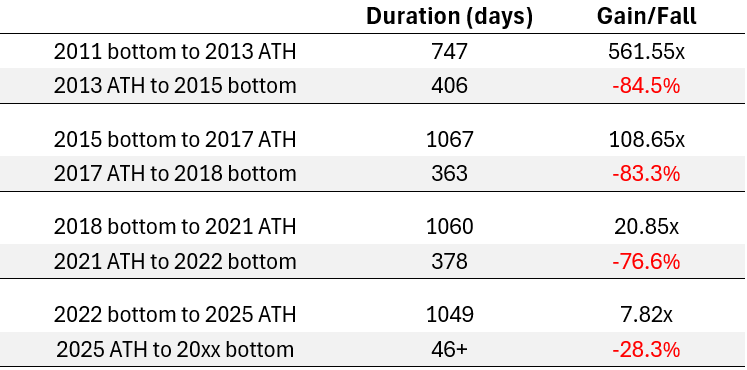

The 1064 day cycle, some of you may have seen this internet lore floating around since 2023.

Remember, trust but verify. I’ll do the hard work here:

This is distressingly accurate.

Why does this work? It doesn’t! Our brains are merely wired to appreciate symmetry and repetition. It means absolutely nothing!

However, it does give us something to anchor on. If history stands, the 2025 high is behind us and we are now in a drawdown phase. The above suggests we are hunting for a bottom sometime in the next 12 months. We don’t know the path, but if we believe a bottom exists, we know the destination.

Choose Your Own Adventure

Let’s build a little framework around this:

We don’t know when it will bottom

We don’t know how far it will

You may think this is stupid, but I believe we will recapture all-time highs again at some point in the future.

If you agree with me that we can get back to ATH, then we can from here choose our own adventure:

At some point, for any investor, the price becomes attractive again.

Someone yesterday possibly bought with the view that we return to ATH within the year. Clearly, they were happy with a ~40% IRR if you took that view

My point is, choose your own adventure!

This is a basic example of looking at forward returns. Read between the lines: this is about becoming a buyer in public markets. It doesn’t have to be Bitcoin; it can be equities or credit. (And if you’re not using AI to model these forward-looking outcomes by now, what are you even doing?)

Don’t Be a Passenger

If you want to buy the dip effectively, you need the ability to rebalance. You must become a liquidity provider when there is no liquidity! But you need liquidity yourself to achieve this outcome.

If you have fully embraced the democratisation, you might be feeling smug because your portfolio didn’t mark down this month. But you also can’t rebalance into a -30% drawdown if your capital is locked up in a private credit fund.

Private markets are great for smoothing returns, but they are terrible for capturing dislocations. Don’t let laziness strip you of your ability to be a liquidity provider when the market actually pays you for it.

Thanks

Well done for making it this far and it pleases me you are reading this sentence. I thank you for reading the above and I hope it has provoked some thoughts.