September Quarter Fund Performance

How can you not make money in this market?

Hi Everyone,

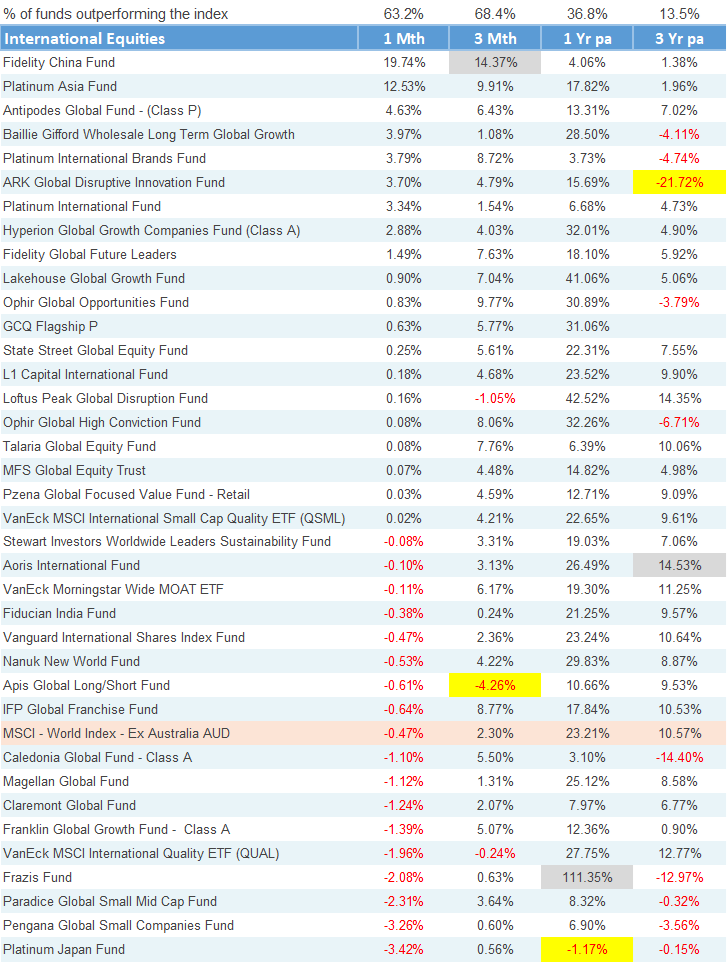

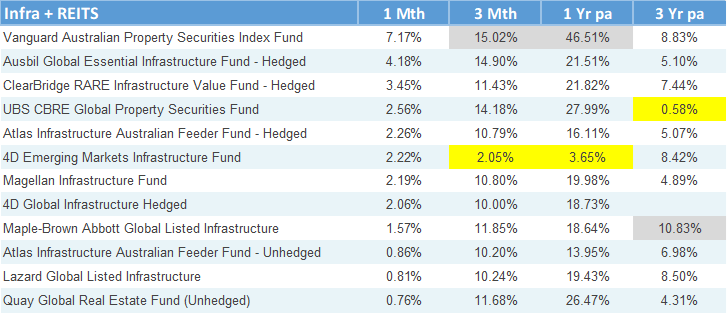

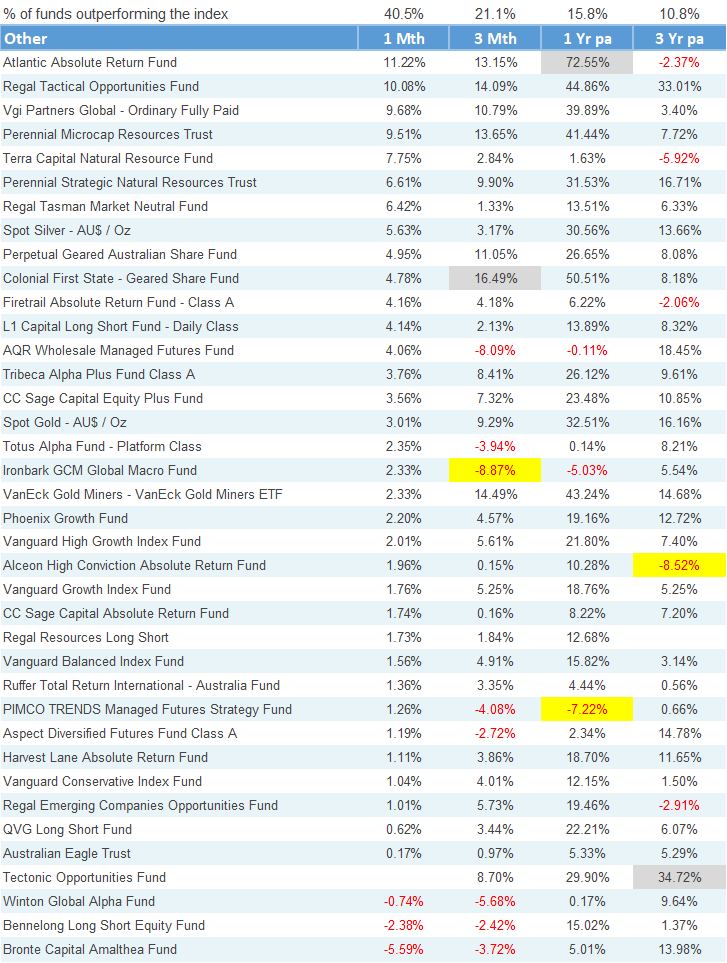

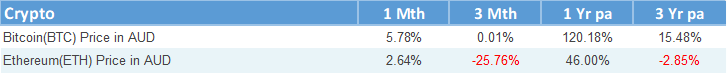

See below month end fund performance data ranked by monthly performance. Quarterly, 1 Year and 3 Year data ranked by:

Best performing funds highlighted in grey

Worst performing funds highlighted in yellow

HOUSEKEEPING

If this forwarded to you, feel free to respond to the Substack email or just send a sign up request on mrquick@substack.com

If you are receiving this via email, I suggest clicking the link and reading directly on Substack. The email formatting does not translate well and the information may appear as clipped or truncated in your inbox due to the size and length of the Substack post.

Fixed Income

Interesting month and quarter as US Fed ended up cutting 50bps which is usually reserved for times of crisis or panic. This is in a period with strong economic growth (just in time for the corporate refi cliff to arrive!)

Some funds heading into risker credits to pick up yield while others are derisking due to super narrow spreads. Big bifurcation in how managers are positioning for the next 12 months, one group completely reliant on rates going down.

Is your Fixed Income allocation defence or attack?

The question again, if you think rates are going down from here, why not express that view via long duration assets like infra or REITs?

Big rally in the US10Y which doesn’t seem sustainable – I won’t how much of this is flight to safety ahead of the election.

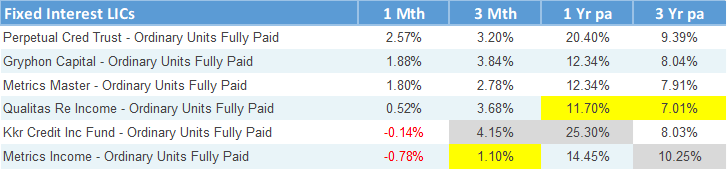

FI LICs

Returns are highly influenced by movements in share price rather than movements in the underlying portfolio value.

These securities potentially become more attractive in the retail market with Hybrids potentially being outlawed (which is insane in itself)

Can you expect these to now trade persistently at premiums to NAV until we hit the next crisis?

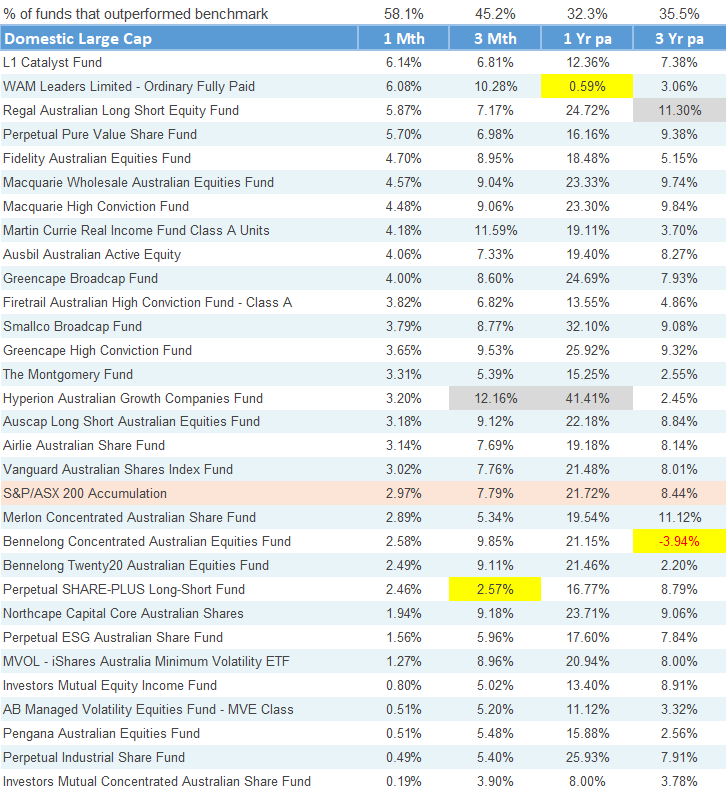

Domestic Large Cap

Almost +8% for the quarter is incredibly rare for the ASX200

Many (if not all?) active managers underweight banks + miners in favour of healthcare (I cannot tell you how many people have pitched CSL at me) or mid-caps (which is doing a lot of heavy lifting for many

Consequence is that active funds have mostly been unable to beat the index. I understand they (claim to) manage risk on the downside, but so hard when you can’t keep up with markets. And this is ultimately showing through in industry flows as many funds losing mandates and passive eating everyone’s pie.

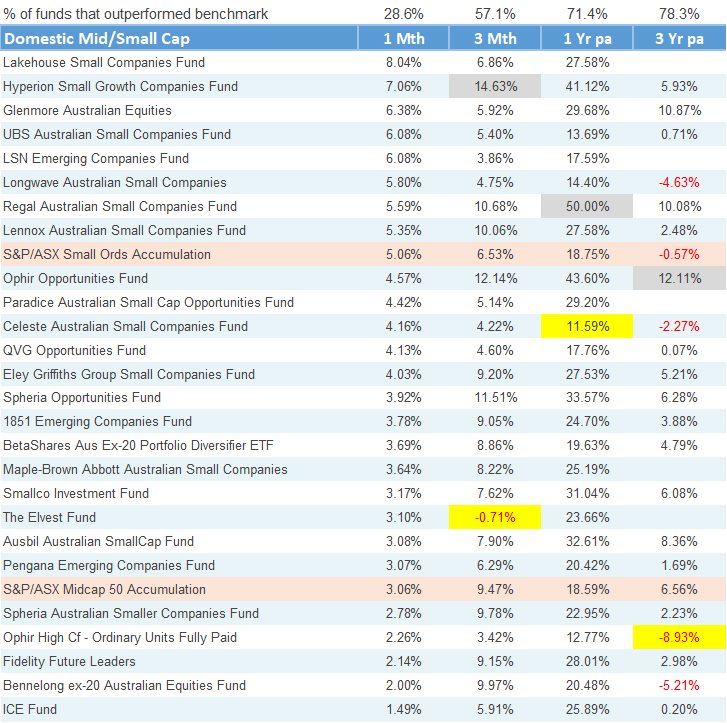

Domestic Mid/Small Cap

Note that I’ve use XSO (ASX Small Ords) as the bench. If I use mid cap then less then 15% have outperformed over 3 years.

On average the names here have beaten large caps over the last 12 months, and remember that small caps were deeply unloved this time last year. Gotta zig while everyone zags.

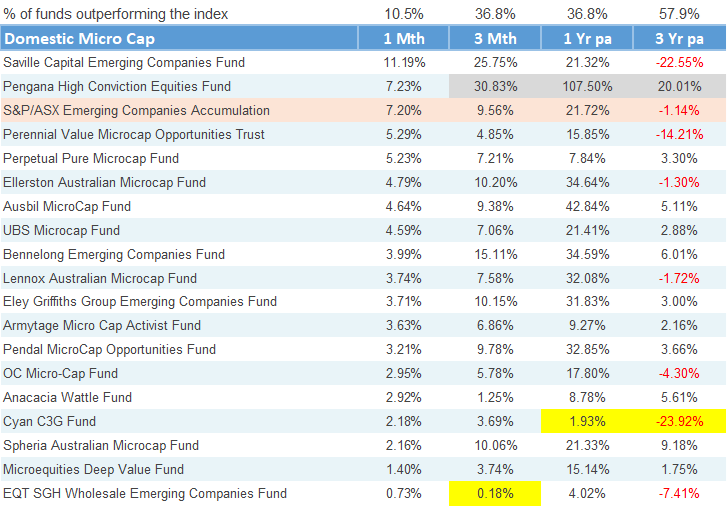

Domestic Micro-Cap

Saville generating more than a year’s return in the space of 3 months

Likewise, the index and the sector despite being deeply unloved has done very well of late

Although IPO window hasn’t exactly opened yet, you can get a capital raise away if you need to and most companies have gotten the message, make money or disappear

Little bit surprised at active management not outperforming

International Equities

Chinese getting a bit of life, value trap as usual or an actual change that results in long term consistent returns? Does the equity market even reflect the winners from the underlying economy?

Let me get this straight, Platinum Japan managed to lose money in the Japanese bull market…

What’s your benchmark? Many funds not exactly quoting the right MSCI World Ex-Aus (AUD) performance as their comparison.

Bull market laggards, less than 40% of managers actually capturing the full market upside over the last 12 months

Infra + REITS

Long duration = outstanding performance as longer duration bonds rallied

Lack of dispersion in infrastructure returns compared to global equity returns is shocking, infrastructure generated excellent returns despite higher interest rates.

Question is, are these pricing in lower rates already so therefore the future performance is not going to be anywhere as good? Or was everything oversold last year and a massive opportunity persists?

Other

Gold still destroying everyone over the last 3 years in every period

Big month for any fund with any kind of commodity related exposure – top quarter of the table playing the trend well

Double digit returns over 3 years for a few funds is very impressive – played the rate cycle and market themes to a tee

GICS Sectors

China coming in and saving the materials sector in the last week of the month/quarter

So banks have done astoundingly well over the last 12 months, what is going to happen when rates are cut and credit becomes more available? How is lending not going to explode?

Energy names still doing poorly despite what I think are relatively stable prices. But likely a mean reversion inside an excellent 3 year period.

Bonus Round

Bitcoin spot ETFs in the US now have approval for options – the reflexivity trade is a go

The meme cycle comes and goes with this space, and if you thought the Keith Gill/Roaring Kitty/Gamestop trade was huge, mark my words that when the next cycle comes around and dealers are forced to hedge deep OTM calls in an ETF that has an underlying security with limited supply, this has the potential to redefine the word “bubble”.

Thoughts of the month

Taken for a Joye ride - Part 11

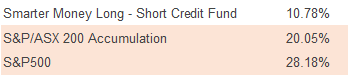

As a reminder, our favourite bearish commenter let everyone know the S&P500 was set up for a “terrible” decade. It’s now been 12 months and despite his fund doing incredibly well, he’s been absolutely stomped by equity markets.

From 13 Sep 2023 to 30 September 2024:

So just to make sure everyone is aware, he managed to very nearly bottom tick markets and anyone who listened to him missed out on a good time…

Are you ready to be gaslit? - AKA private markets - Where opportunity demands its price of privilege

This bit is going to annoy a LOT of people, especially some that read this, but I can see the cogs of the marketing machine turning to gaslight you into making undesirable portfolio decisions.

If you have a keen eye and look at the tables above, you’ll see that active management (in equities) has had a horrid time over the last 3 years. Yes, there are always excuses but as investors, unless you’re absolutely on top of managers covering their investment styles, underlying securities, decision making processes and market views – on average you’ve had a worse outcome than just investing in the major equity indices over the last 3 years.

And this is influencing active management in Australia – the share of active vs passive is shifting as passive vehicles are becoming more prominent. The retail space is no longer the ripe pickings it once was so the fee share and profitability of managers has fallen over time. The obvious method of counteracting this is to remove your active management from the passive comparison in the first place – thank god for “Alternatives”. If you can do that, you can launch new high-fee products that fit within the “Alternatives” bucket that all investors absolutely need to think about increasing their allocation towards – I mean all the institutional investors like industry super and the future fund are, so why aren’t you?

The thing about having to deploy many billions of dollars is you need to think about what assets you can potentially access. Industry funds for example can’t move the needle for their investors (ahem, sorry I meant “members”) by investing in markets like Australian small caps as these markets are too small in size relative to the quantum of capital they manage.

Luckily you and I don’t have this issue, and the size of our portfolios isn’t going to move the market in any way shape or form, so we don’t have a pressing need that exists in institutional markets to access private markets to deploy capital.

I’m not saying that private markets are a bad thing, I think they absolutely have their place in portfolios (I’m a huge fan of private credit!) but instead the range of options for investors in Australia is about to explode and you’re going to be asked to invest in private markets because everyone else is – but boy are you going to be paying for it, 2%+ ICRs are normal.

(Maybe the play here is an investment in an asset manager within the “alternatives” space that has historically shown outperformance, has a strong distribution team and aren’t shy to lock in a pound of fees. A Merchant of Alternatives so to say)

Let’s talk about what is actually important.

Geopolitics kills me. Constant negative talk, noisy signals, no real information to move the needle. People worry so much about so many things, so let’s talk about what is important.

Part 1 - Geopolitics

The Russia-Ukraine conflict offers insight in how regional disputes can spiral into global economic disruption. While the conflict initially appeared as a confrontation between mismatched economies - the world's 8th largest versus the 58th - Ukraine's outsized role in global commodity markets proved critical. The involved parties were major exporter of wheat, coal, and oil and the disruption of exports sent shockwaves through global supply chains. This created a perfect storm that helped fuel global inflation and forced central banks worldwide to aggressively tighten monetary policy.

In contrast, the current Middle East tensions, while politically and humanely significant, have markedly different economic implications. The GDP disparities are telling: Israel (27th) versus Palestine (116th), Lebanon (112th), or even potentially Iran (40th). Unlike Ukraine's crucial commodity exports, the key exports from this conflict zone - primarily from the Israeli military-industrial complex - remains relatively insulated from disruption. Meanwhile, global oil markets, traditionally sensitive to Middle East conflicts, have shown surprising stability - a result of record U.S. production levels (shale revolution) and softening Chinese demand (forget stimulus, demographic and energy transition headwinds).

This isn't to minimize the humanitarian significance of any conflict, but rather to understand why financial markets have responded differently to these events. The Russia-Ukraine conflict fundamentally disrupted global supply chains and monetary policy, while the current Middle East tensions, despite their serious nature, have had a more contained economic impact.

The world will continue turning and the middle east will continue to pump oil.

Part 2 - So, what is priced into markets?

The challenge of pricing political risk into markets is a fools game.

Take for instance the potential implementation of a 60% tariff on Chinese imports to the US as proposed by Trump. Such a policy would create far-reaching implications for major American corporations that are taxpayers, especially ones that are reliant on Chinese manufacturing & imports (I can think of a couple). It’s the ripple effects that worry me, the ones that extend beyond direct corporate impact but instead to influence supply chains, consumer prices leading to higher inflation, and ultimately, disrupt economic growth patterns & monetary policy.

However, as of now, much of this remains speculation, and it's challenging to decipher what is priced into the markets and what is mere conjecture. Large political or economic changes often result in market volatility, and in situations like this, why not just observe before making decisions?

What I’m saying makes sense right? Except absolutely everyone is on this trade.

Implied volatility is super-duper high for the next 30 days or so and many traders & funds I speak to are choosing to derisk into the election (in their own way). But I find it hard to believe that volatility doesn’t get crushed at some point below the levels markets are implying today and frankly markets will absorb events and move forward, the wall of worry means nothing here.

The argument against this is my gut says markets do feel a little bit priced to perfection and the biggest drawdown on the ASX200 this year has only been -5.3% vs a median annual drawdown of circa -10%.

Arguments for and arguments against, but does it really matter?

The world will continue turning and the largest global economy will continue to produce goods and services.

Thanks

Well done for making it this far and it pleases me you are reading this sentence. I thank you for reading the above and I hope it has provoked some thoughts.

Formalities

If you are thinking about starting a new fund, are a new manager or an existing manager, an analyst, or would like your vehicle to be part of the list I track, I’m always keen to chat.

Likewise, if you just want to have a good old chat, I’m always free to do that too :)