September Fund Performance

Hi Everyone,

See below quarter end fund performance data ranked by monthly performance.

HOUSEKEEPING

If you want to read this with interactive tables and charts, click below:

OR JUST CLICK HERE

If you are receiving this via email, I suggest clicking the link and reading directly on Substack. The email formatting does not translate well and the information may appear as clipped or truncated in your inbox due to the size and length of the Substack post.

If this forwarded to you, feel free to respond to the Substack email or just send a sign up request on mrquick@substack.com

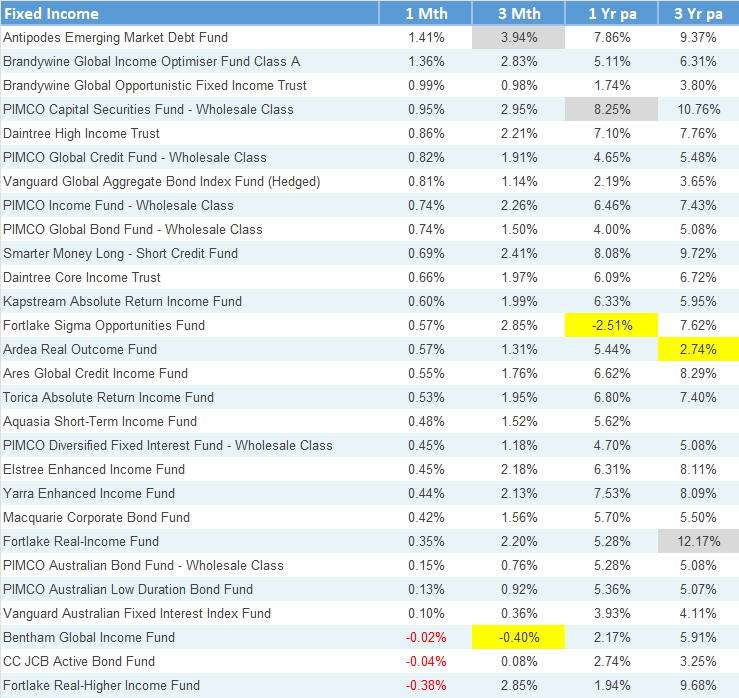

Fixed Income

Peak rates? I mean it, base rates continue to come down meaning the chase for yield is only beginning.

And we’re seeing the longer end of the curve in the US and Aus start to fall too - sovereign risks not withstanding

Interestingly, the US deficit is the most balanced in years. The worst is over? Imagine if they can truly narrow the deficit. No one is ready for that conversation yet.

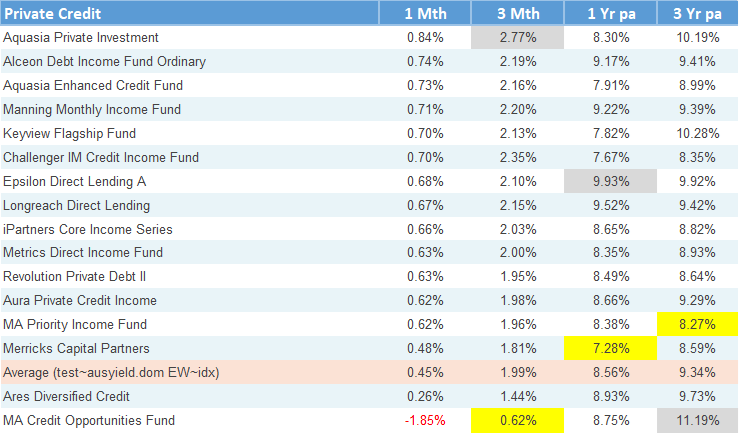

Private Credit

More on this in the thoughts of the month, I am vehemently opposed to the narrative across all media on this subject.

ALL the front page credit stuff we’ve seen recently is due to fraud, therefore not systemic.

ASIC stuff is going to be interesting, good to see they finally pushed out something on private credit funds lending at mid-teens and passing through returns only at high single digit returns to investors.

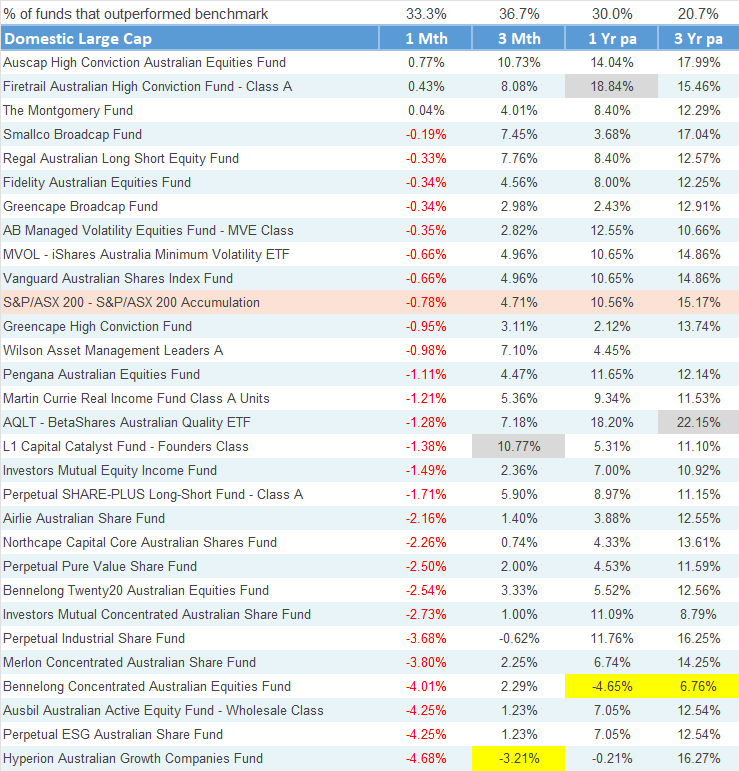

Domestic Large Cap

Challenging for many, if you’re hiding from bank exposure, most have gone growth or healthcare. CSL is the ultimate pain trade.

CBA - I have a note on this, once again about narratives and I am going to try to answer the adage question, who the hell keeps buying?

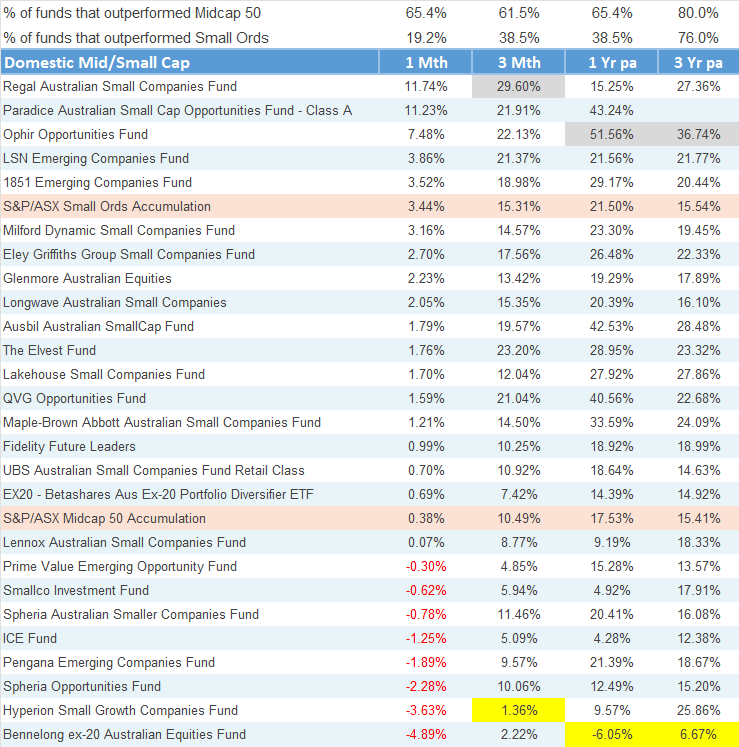

Domestic Mid/Small Cap

Bennelong, what are you guys doing? The delta to the benchmark is ridiculous

Cracking bounce by Regal considering they got wiped on Opthea & the Trump trade

Ophir killing it, pity you can’t actually put any money into that fund (maybe I should only cover open funds here)

Milford PM (hey mike) pointed out to me that our benchmark actually has gold in it! One of a small number of indices around the world where an active manager can legitimately play in gold.

Goes to the point that allocating here can really move the needle as there is plenty of alpha just sitting around

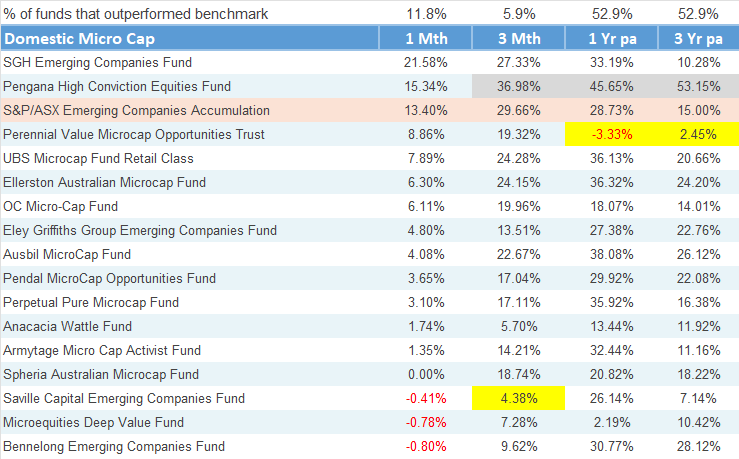

Domestic Micro-Cap

The best index in the world? If you had cojones and allocated a year ago, would have absolutely printed money

But lack of managers, many have disappeared from this space

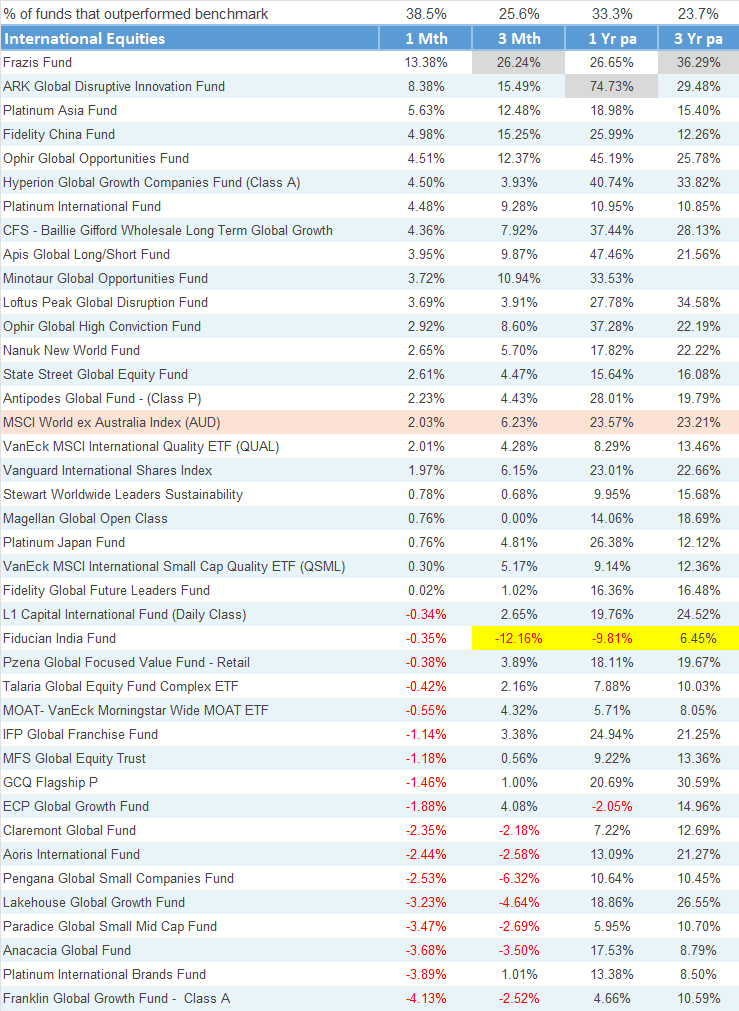

International Equities

Rising tides raise all boats (especially ones that were sinking?)

A market where if you invested rationally, you got killed. Negative FCF businesses (read:risk on) winning again for the first time in 3 years

QUAL ETF which received huge inflows over the last 3 years and changed the vocabulary of every global equity manager to mention “quality” is now lagging the benchmark by 10%pa over 3 years

If you didn’t play in any semiconductor stocks or win from the AI trade, what were you even doing?

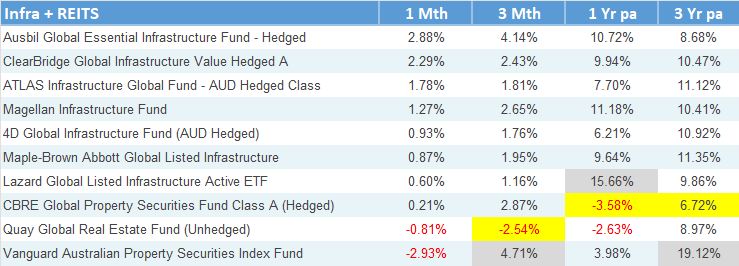

Infra + REITS

VAP Machine, I honestly don’t know anyone who still holds the Aussie REIT Index

A story where I firmly believe public markets have allocated efficiently yet private markets just haven’t corrected to this extent.

And honesty hour is upon us, there is a 6 month window in my view where forced/board led/liquidity demanded divestitures are happening

The next cycle is resetting right in front of our eyes

When did you last see a shopping centre or an office block get built around you?

Housing isn’t the only catch point with immigration and the excess supply will disappear rapidly.

Supply cannot and will not come on quick enough, the bullwhip is in effect.

Other

GDX finally catches up to gold! And still looks damn cheap.

Heaps of long/short funds continuing to punch the lights out and a few that managed to find a way to lose money last year

Vanguard Balanced doing 11%pa over 3 years and Growth doing 14%pa over the same period is abnormal, but catching up from the poor 2022

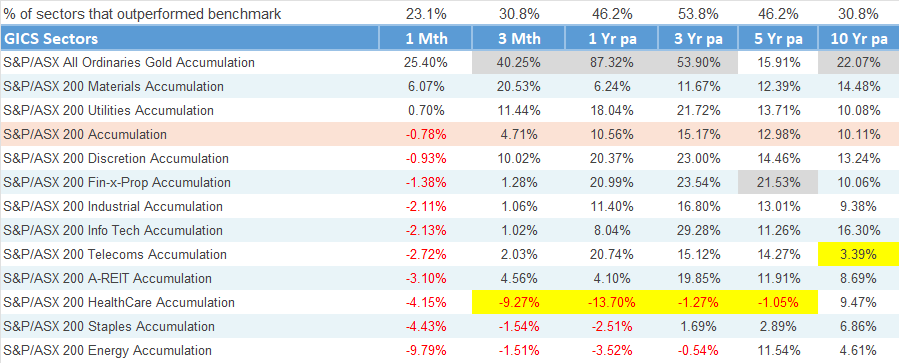

GICS Sectors

Longer dated data here

5 year numbers includes the 2022 inflation led drawdown

Healthcare driven by not only CSL but is a big part of the story

Divergence of consumer facing businesses I find perplexing

Consumer staples index hasn’t even kept up with inflation over the last 5 years, can you believe there was a supermarkets inquiry that ended earlier this year??

Consumer discretionary fascinates me, everything you hear about the rising cost of living is nonsense. Houses were cheap between 2020-2022 and people really like spending money today.

Materials look very interesting now, the penny is dropping on copper.

Bonus Round

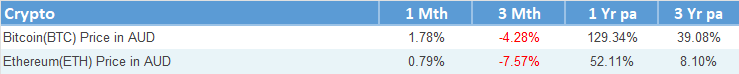

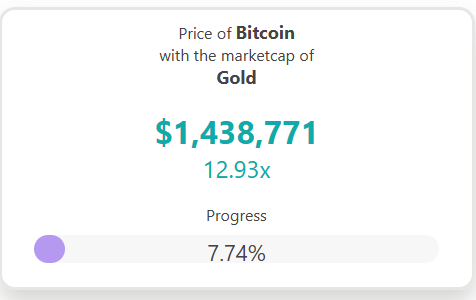

Breather for BTC, but it is still outperforming gold over the last 1 and 3 years.

BTC catches up to gold in the run to the end of the year?

The flippening is still quite some way away.

Thoughts of the month

Who keeps buying CBA

Because it’s not us. Aussies are selling the thing like it’s a used car with a weird noise.

We all sit here staring at the screen, watching CBA moon and think, surely this thing has to come down. And yet it won’t bloody quit

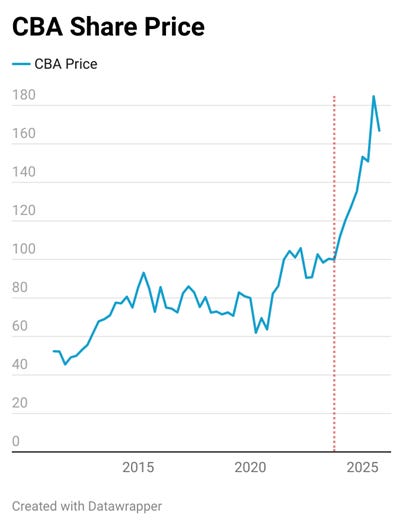

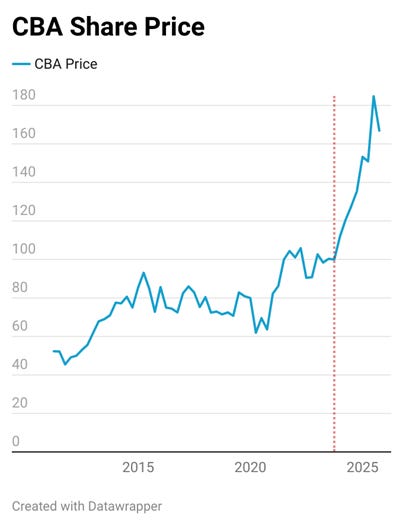

We sit here and think, what in the world is happening? Maybe there are some clues in that inflection point. 30 Sep 23 as marked in that vertical line, keep that in mind, it’ll come up a few times now.

Thinking about where you’re overweight

I despise index overweights, it means I’m being forced to actually think about something and have a view on a position.

I’ve been banging my head on why CBA keeps getting bid up, so to answer the question, let’s think not of ourselves for a moment and think about why there might be more buyers than sellers.

Firstly, lets tackle the industry super/mysuper question off the bat. If the flows are to the index then shouldn’t all boats rise equally? Why should the biggest index constituent become bigger? Is it reflective of a tight capital structure and low free float? Low free float in the biggest stock on the ASX? Yeah, nah.

I’m finding that the reason a company goes up or down within an index is not passive flows, but rather active flows.

Its all about relativity

Some hedge fund manager in NY who probably hasn’t slept since 2019, staring at his Bloomberg screen at 3am, thinking about where to allocate. Already loaded to the gills on US equities, already at limits on Europe and don’t really want to allocate more to socialism, can’t go China because that’s unamerican.

Straya mate.

Looking in, our little backwater country had the audacity to trade at parity to the US dollar about a decade ago and recently it traded down to the low 60c mark.

The dollar snapped from the high 60s down to the low 60s in lets round it to 30 Sept 2023.

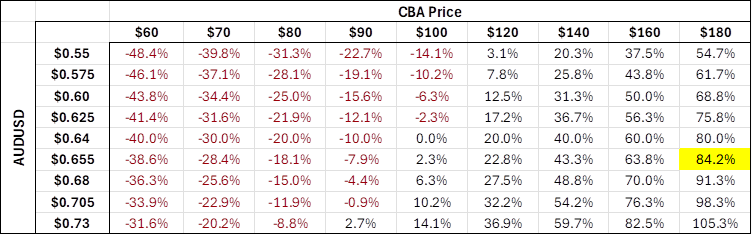

What if you could bet on the Aussie mean reverting to the US Dollar? And what if you could hold an AUD asset of the highest quality that could even pay you a yield to hold, the ultimate carry trade, you get paid to take on a mean reversion.

Which Bank? Why Our National Spirit Animal

Everyone looks at CBA and sees an appliance. Camry, bulletproof, reliable & totally dull. Exactly what scares every investor into thinking they’re missing something. And that’s the trick, there’s nothing to miss.

But looking from offshore, there are a few things interesting from a global perspective. Excellent domicile where the law works, a rational (over)regulated banking industry with few players, and shareholders are treated like kings.

A trade

For anyone with that view (ie an offshore investor), AUD + CBA could potentially have been an amazing asymmetric trade.

Judging this as a US based investor back in Sep-23, the AUDUSD was around 64c and CBA traded at $100. Inflation was coming down, rates looking like they’ve peaked.

And you could back this bank that traded flat since covid around the $100 mark while paying around 4.5%pa.

Pile into this trade you can’t lose money! At some point the AUD bounces and, the payout is amazing, you can easily underwrite 10%+ IRRs

And more importantly, because of the yielding nature of the bank, you’re getting paid to take on the mean reversion risk.

If the Aussie goes to 50, great, buy more. If it goes 70+, sell and buy yourself another boat

Am I right or wrong? I don’t know, this is just a guess. I could be soooo wide of the mark here. Maybe it’s the same investor, but instead they’re buying APAC exposure because the ASX looks relatively cheap on a global basis back in Sep-23.

Reading Tea Leaves

What I’m trying to show is that investors could justify holding CBA (Sep-23?) from an offshore perspective, and the reason CBA has ramped from $100 at it’s current pace is due to offshore influences.

Not kidding, the clues for this stuff exists. Data from CBA.

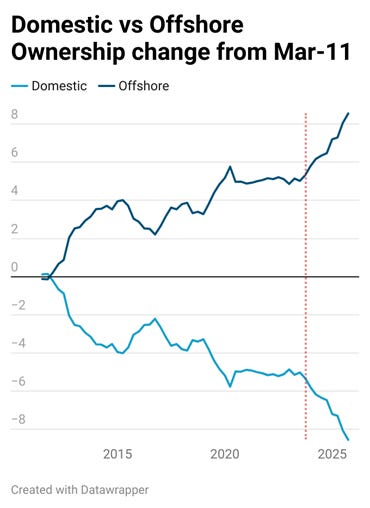

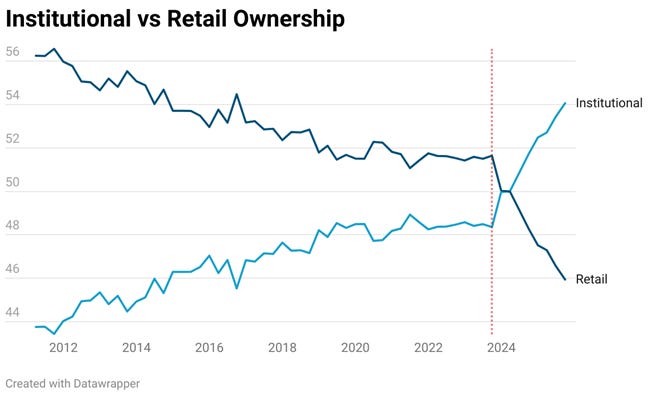

Domestic investors have been responding to the price rise by quite logically selling. And offshore buying ramped up at the 30-Sep-23 mark like someone flipped a switch.

But the more damning chart is the one that shows Retail ownership, a drastic shift in the ownership of CBA.

We can all have a theory about why offshore institutional investors are buying, but we can definitively say that the rise in price since September 2023 has been due to offshore buying.

Back to the share price chart

There are more buyers than sellers. The buyers are not Aussies. Aussies are net sellers

Beauty is in the eye of the shareholder

Some truths and some maybe some fictions in the above, but this isn’t enough.

As I said, I’m being forced to think about this because these pricks have bid up CBA so much that it’s still outperforming my own BTC/Gold holdings. And I need to know why, why does our Jolie laide continue to be so attractive to others.

So let’s stick to facts for a moment.

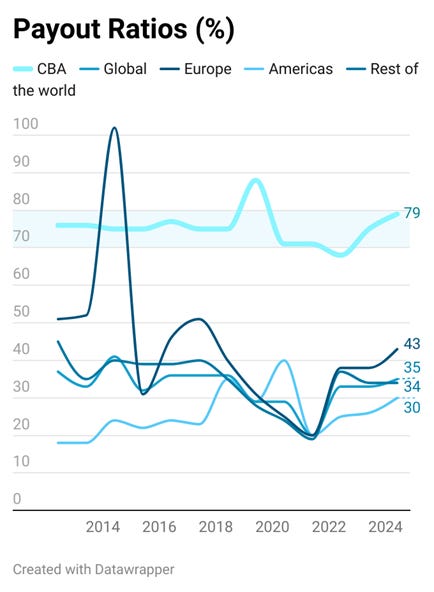

CBA generates decent yields but more importantly, unlike any other bank in the world, management clearly states they will distribute whatever they can and the payout ratio is absurd. It is the hidden golden nugget.

Management have stated payout ratios between 70-80% vs the rest of the world around 30-40%.

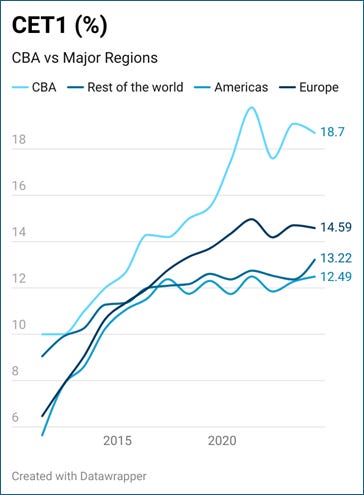

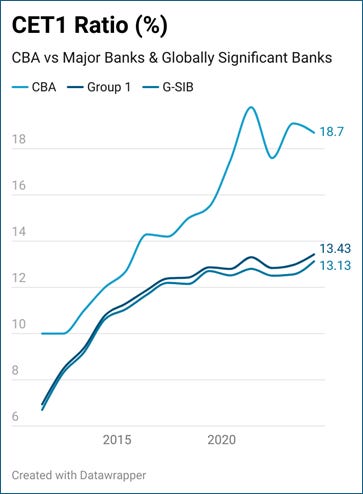

This inadvertently points to quality. Quality just everywhere, balance sheet, market position, capital ratios, profitability, no need for additional capital elsewhere, overall capex needs.

And you know what, the friggin app works so well! No one can doubt just how good their tech platform has been for years from a consumer perspective.

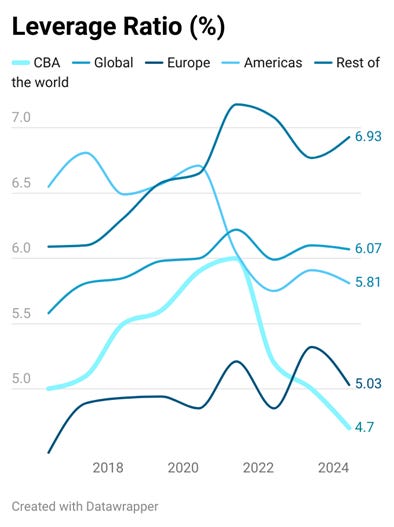

You can argue leverage ratios are high, which is true, but capital ratios are best in class.

Super well capitalised, management don’t do anything silly, the consumer touch points are pretty good, and they’re determined to distribute whatever they make.

When you factor in regulatory capture, CBA isn’t a bank, it’s practically infrastructure. It’s a utility. And utilities are supposed to be boring and profitable, sounds familiar.

A no brainer? Quite literally the best bank in the world and a bet on CBA is a bet on Australia right?

Do I buy or do I sell?

I’m still stuck, but I know I can justify holding it with what I’ve outlined here. The fact is it’s probably the best bank in the world with more buyers than sellers today.

Something changed in September 2023 and I’m not sure what, I’m just worried now that it might change back to the previous state without notice.

Do I buy or do I sell? The answer is the risk the market gives you is not a risk you need to take on as an investor. The market gives you a certain type and amount of risk at any given time. The risk has a term structure too.

Its your job as an investor to not just take the risk the market gives you but rather trade around the risk.

Private Credit Narrative Violation

Everyone’s panicking about private credit. It’s a bubble Jamie Dimon’s warning about cockroaches, and headlines screaming about a credit crisis. We get it, private credit is toxic.

But I challenge the narrative, and I think its mostly nonsense.

Let’s look at what actually blew up recently. First Brands defaulted. Tricolor went bust. A few banks suddenly decided to take write downs on fraud exposure. Everyone is pointing fingers at private credit.

Receipts

Tricolor - 100% fraud. So bad they didn’t even bother restructuring the business because there was nothing legitimate to restructure.

Lenders - JP Morgan, Barclays, Fifth Third Bancorp.

All banks. Zero private credit.

Zion Bank and Western Alliance - these are banks

Used the current environment as time for confessional

Reviewed their books and found fraud exposure.

The borrower is a fund manager (Cantor) buying distressed mortgages

The borrower wasn’t actually buying distressed loans. They were lining their own pockets with the borrowed money.

Once again, this was bank lending through syndication. Not private credit.

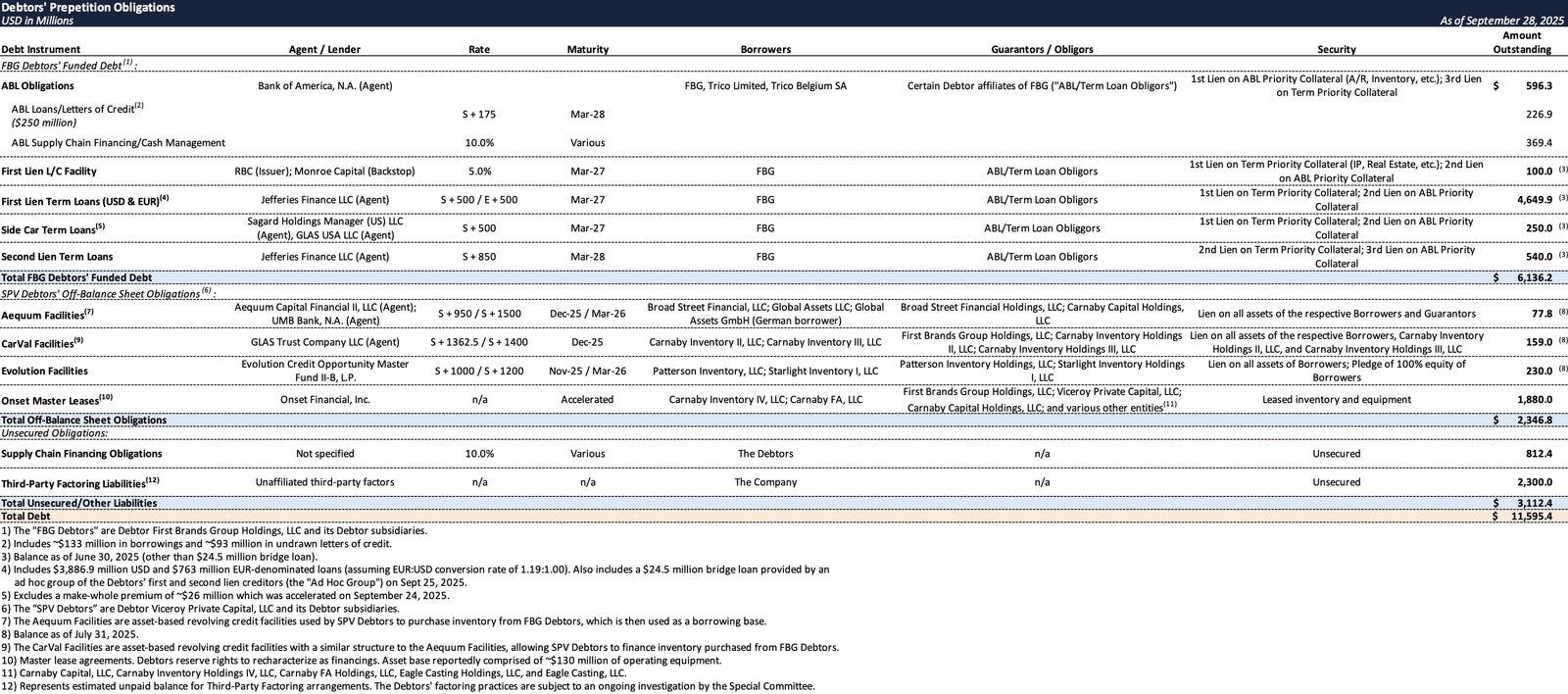

First Brands – a bit more interesting, 100% fraud by the way.

$9 billion in balance sheet lending, $2 billion off-balance sheet.

Majority of the lending structure was broadly syndicated loans

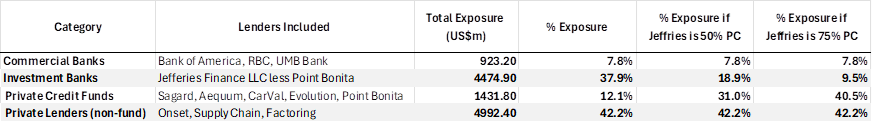

Some private credit mix, agressively, I’m getting to around 40%

So let me state this plainly: every recent credit event we’ve seen has been either (a) 100% fraud or (b) unrelated to private credit.

First Brands

This is an interesting one. From Zerohedge the debts outstanding against First Brands:

Let’s break this down to exposure by lender types:

Don’t know what Jeffries is at this stage to the opacity of the deal structure. If you call it 75% private credit (incredibly aggressive) then PC funds represented 40% borrowing.

In terms of what retail investors were exposed to, the BDC market which is the equivalent of our Fixed Income LIT (MXT, QRI, etc) & managed fund market, it was exposed to approx. $237m representing approx. 0.05% of the industry. 15 funds out of 166 held First Brands.

What Failed?

So the credit things we’ve seen in the US market today are 2 things:

Complete due to fraud

Fraud that permeates both public and private credits.

And let’s take it one step further, if we look at the failure points, they were all fraudulent loans done via syndication.

Private credit ideally ends up being managers who end up writing their own direct loans (ie not a syndication). And you’re hoping the individuals underwriting these loans can pick up unscrupulous individuals you don’t want to give your mum & dad’s money to. Well sometimes that doesn’t happen and we have our own First Brands event at home.

Hey look over here

Then Jamie Dimon comes out warning about cockroaches in private credit.

JP Morgan took a $170 million write down on fraud loans. But somehow the narrative became “private credit is dangerous.” Let’s be real, its excellent misdirection.

Are you ok?

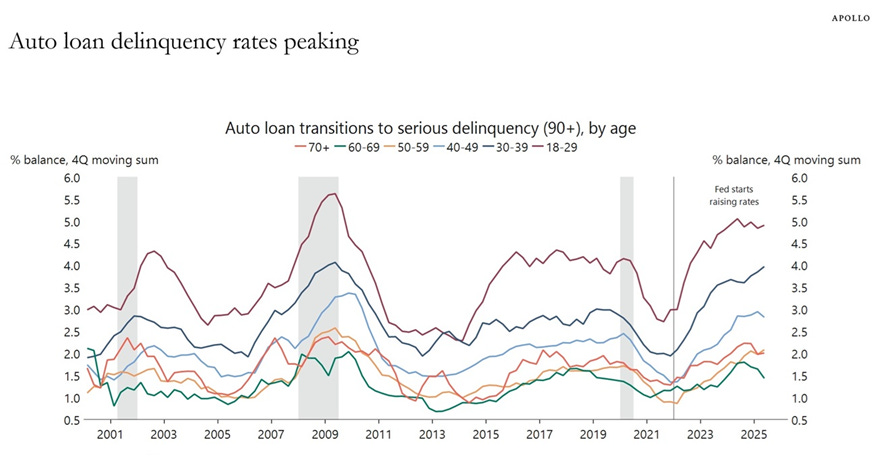

If you ignore the news cycle and just look at the actual data, here’s what’s happening from Apollo.

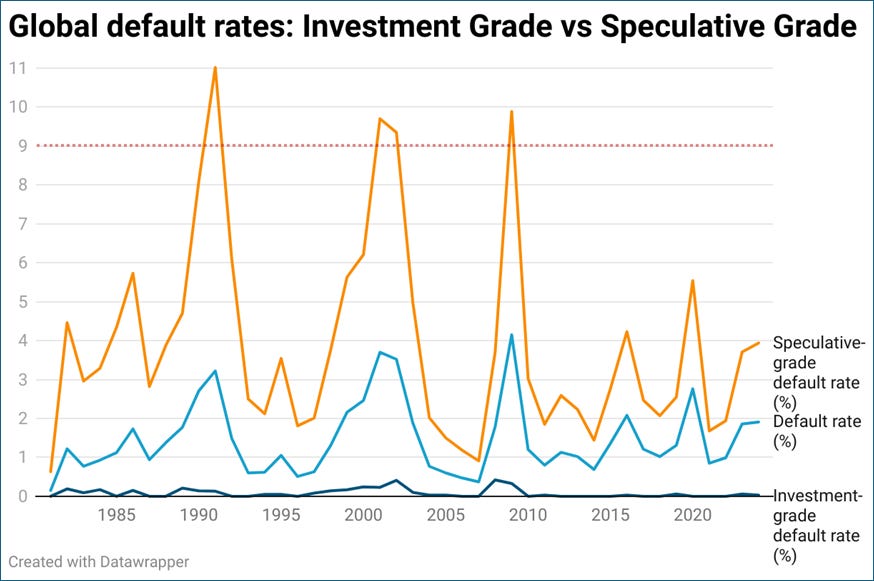

Default rates are coming down (more on this in a sec)

Auto loan delinquencies are coming down.

And, credit card delinquencies are coming down.

The narrative says private credit is blowing up. The data says credit is actually normalizing. One of those has to be wrong.

Parallels

This isn’t about what is right or wrong, I’m sure there is plenty of stuff wrong in private credit, but to say the recent events have anything to do with private credit is a lie. It was fraud.

Factoring and trade finance stuff scares me. Lending on receivables is represents pure financial engineering with lots of room for dishonest behaviour. If you’re not an apex predator in that space as a lender, you’re going to get killed. We’ve seen this before and we will see it again.

Greensill looked like supply chain finance but made huge bets on receivables. It blew up thanks to GFG, everyone talked about the risks of alternative finance. But Greensill wasn’t alternative finance, it was banks (and insurance companies) trying to juice returns and other risky bits through a non-bank wrapper. Same stuff we’re seeing now where banks get involved or make or originate the bad loans, then blame private credit when it goes sideways.

Where to from here, a framework for approaching private credit

Fraud is not business as usual stuff and not representative of industry issues in my view. But the business as usual stuff is defaults. And defaults are perfectly normal! Banks have defaults on their books all the time!

Default rates are probably the thing you want to be looking at, but then one asks, how can you even tell what the default rates are in private credit markets?

My thesis here is private credit is refinancing big chunks of the speculative grade/high yield/below BBB market, so why don’t we just look at historical default rates so you can get an idea of risks involved. This is S&P data on default rates and the above chart from Apollo is a continuation showing that spec default rates are coming down now.

Historical default rates have peaked around 9%, so lets take that and chuck another 5% on for good measure - a 15% default rate in private credit during a recessionary cycle?

Speculative/High Yield defaults average around 4% and I’m not even counting the recovery rate here. If you’re in a private credit fund earning 8-10% per annum and you get a period where you cop a 10% drawdown in a recession, guess what? Totally normal!

Look, I’m sure there’s plenty of stuff wrong in private credit. But the truth doesn’t lie in the front page of a newspaper. Private credit is a neat little wrapper for all things financed privately with no regard for risk, no 2 vehicles are built the same.

Basel regs have forced banks to abandon any of this kind of lending, so this part of the market needs to be funded no matter what, there is constant supply of those that require financing.

And the ultimate truth is probably somewhere in the middle, where defaults & recoveries are perfectly normal parts of credit markets.

Thanks

Well done for making it this far and it pleases me you are reading this sentence. I thank you for reading the above and I hope it has provoked some thoughts.